By Chris Hinde

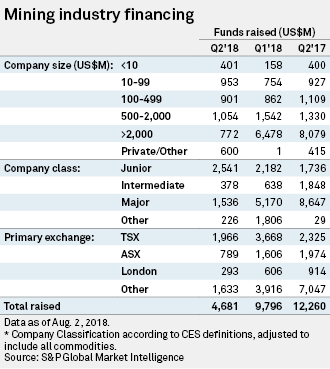

(SNL News) Funding for the mining industry collapsed in the June quarter, with financing transactions raising barely US$4.68 billion, compared with US$9.80 billion in the March quarter, US$6.10 billion in the December 2017 quarter and US$12.26 billion in the year-ago period; see table below.

As highlighted in S&P Global Market Intelligence's recently published State of the Market, or SOTM, report for the three months to end-June, the shortfall came from the larger companies. Mining corporations with a market capitalization of over US$2.0 billion raised less than 17% of the total, compared with a share of 66% in each of the previous and year-ago quarters.

The SOTM report attributes the sharp drop in financing by the larger companies to relatively high cash holdings, rising interest rates and caution over investment in new projects. The latter is understandable given falling metals prices and volatile economic conditions. Financing by the smaller companies was little changed in the June quarter, perhaps because their cash holdings remain low and because of their need to fund ongoing exploration projects.

The mood has also been reflected in the industry's market capitalization, which has drifted lower this year. After reaching a near five-year high of US$1.643 trillion at the end of January, the 2,400 listed companies monitored by S&P Global Market Intelligence saw their combined market capitalization retreat in February and March. After stabilizing at about US$1.500 trillion in April and May, the market valuation slipped to US$1.459 trillion by the end of June, barely 1.5 times that of Apple Inc.

The SOTM report notes that this malaise is hardly unexpected, with the World Bank warning in its latest Global Economic Prospects report that the "possibility of financial market stress, escalating trade protectionism and heightened geopolitical tensions continue to cloud the outlook."

Indeed, the president of the World Bank Group, Jim Yong Kim, was quoted in June as saying the global economic outlook is subject to "considerable downside risks," and "the possibility of disorderly financial market volatility has increased."

The industry's mood was not helped by a Special Focus report from the World Bank, "The Role of Major Emerging Markets in Global Commodity Demand." In this report, the World Bank signaled a long-run slowdown in global commodity demand, which it said could put a cap on commodity price prospects and thus on future growth in commodity-exporting countries.

Separately, the IMF warned that the outlook for commodity consumption is clouded by ongoing trade tensions and waning support for global economic integration in some advanced economies. In July, the IMF announced that the balance of risks has "shifted further to the downside" because of announced and anticipated tariff increases by the U.S. and retaliatory measures by the country's trading partners.

Given this uncertainty, it was not surprising that the price of some metals has reached lows not seen in months. Analysts attribute this to the heightened global trade tension, aggravated by new data that showed a slowdown in June for China's import growth.

Nevertheless, softening metals prices do not appear to have influenced exploration yet. As reported in the SOTM report, drilling activity remained robust during the three months to end-June, and at the halfway point of 2018, there remains cause for optimism. Funding for exploration and the number of drill assays have maintained their positive trends since early 2016, which suggests the current global economic and political uncertainty has yet to cloud the mining sector's own outlook.

(Source: www.snl.com)